The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC]

![The First Step: Getting Pre-Approved for a Mortgage [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240302/16/original_c4b285dd-e681-4c0d-ae60-1aed00e182af.png)

Some Highlights

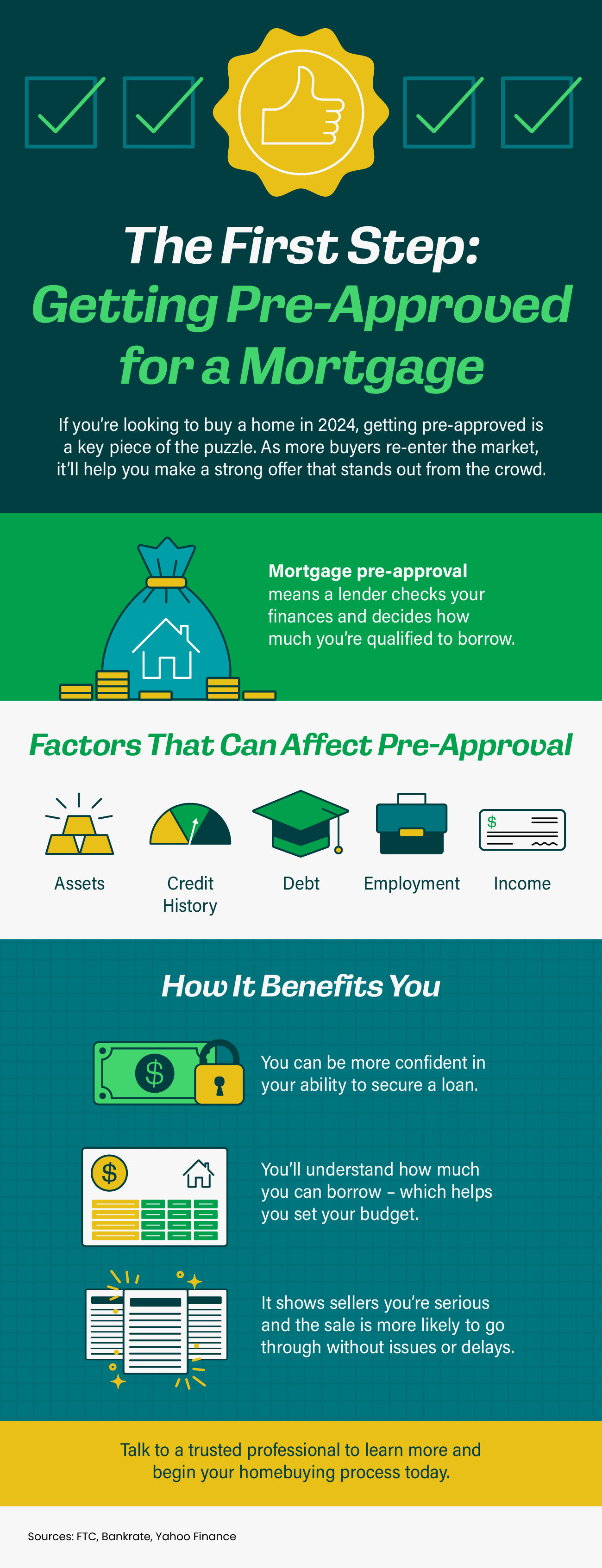

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Categories

- All Blogs (781)

- Buyer's Market (9)

- Cash Flow (2)

- Design and Maintenance (42)

- Featured Listings (6)

- First-Time Home Buyers (39)

- Holidays (5)

- Home For Sale (7)

- Home Loans (3)

- Home Pricing (3)

- Home Showing (2)

- Homeowners (24)

- Investment Properties (9)

- Market Update (10)

- Mortgages (9)

- Real Estate Fun Facts (12)

- Real Estate Investors (22)

- Real Estate Marketing (13)

- Seller's Market (4)

- Selling Your Home (20)

- Sold Homes (12)

- South Jersey Updates (26)

- This Weekend Happenings (28)

- Tips For Home Buyers (17)

Recent Posts

Real Estate Market After the Election

![Builders Are Building Smaller Homes [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240504/16/w600_original_39aacbf5-2468-464c-acda-b86e3e29eff4-png.webp)

Builders Are Building Smaller Homes [INFOGRAPHIC]

Weekend Adventures: Free Washes, Fairy Tales, and Furry Friends in South Jersey

Decoding Debt-to-Income Ratio: What It Means for Your Homebuying Journey

What Is Going on with Mortgage Rates?

The Hidden Pitfalls of Online Listing Surfing: Why It's Not Enough

The Perks of Buying over Renting

Unlocking the Door to Your Dream Home: Insider House Hunting Tips

What More Listings Mean When You Sell Your House

Now’s a Great Time To Sell Your House

GET MORE INFORMATION