The Hidden Pitfalls of Online Listing Surfing: Why It's Not Enough

In today's digital age, it's easier than ever to search for homes online. With just a few clicks, you can browse through hundreds of listings, each promising the perfect blend of location, price, and features. While online listings can be a valuable tool in your house hunting arsenal, relying solel

Unlocking the Door to Your Dream Home: Insider House Hunting Tips

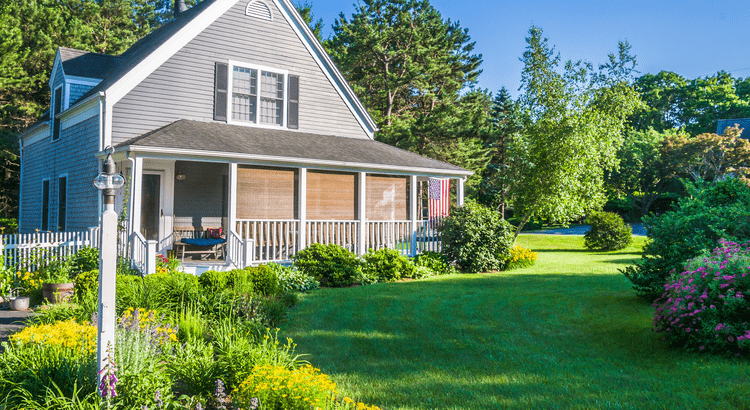

House hunting can be an exciting yet daunting experience. From finding the perfect neighborhood to negotiating the best price, there are many factors to consider when searching for your dream home. In this blog, we'll share insider tips and strategies to help you navigate the house hunting process

Navigating the Ins and Outs of Real Estate Insurance: A Comprehensive Guide

When it comes to buying or selling a home, insurance is a critical component of the process that can often be overlooked. From protecting your investment to ensuring financial security, understanding the ins and outs of real estate insurance is essential for both buyers and sellers. In this comp

Categories

- All Blogs (781)

- Buyer's Market (9)

- Cash Flow (2)

- Design and Maintenance (42)

- Featured Listings (6)

- First-Time Home Buyers (39)

- Holidays (5)

- Home For Sale (7)

- Home Loans (3)

- Home Pricing (3)

- Home Showing (2)

- Homeowners (24)

- Investment Properties (9)

- Market Update (10)

- Mortgages (9)

- Real Estate Fun Facts (12)

- Real Estate Investors (22)

- Real Estate Marketing (13)

- Seller's Market (4)

- Selling Your Home (20)

- Sold Homes (12)

- South Jersey Updates (26)

- This Weekend Happenings (28)

- Tips For Home Buyers (17)

Recent Posts

![Builders Are Building Smaller Homes [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20240504/16/original_39aacbf5-2468-464c-acda-b86e3e29eff4.png)